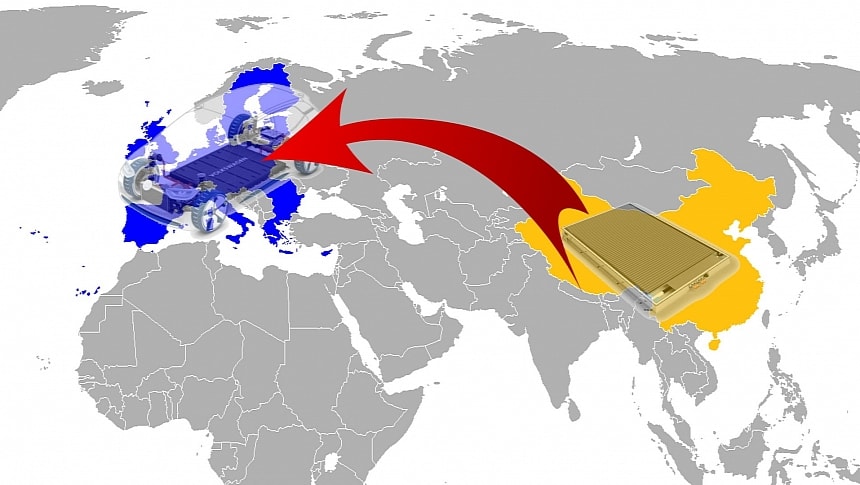

Several battery electric vehicle (BEV) buyers in Europe were surprised when the cars they wanted to purchase got more expensive. They shouldn't, considering that the European Union (EU) now charges "provisional countervailing duties" on electric cars imported from China on top of the 10% standard import tax. The surprise probably came from models they did not know were made in China, such as the Tesla Model Y, BMW iX3, or the Dacia Spring. The European Union states this is a way to protect "EU BEV producers," but is it?

To answer that question, you have to ask another one: who are these manufacturers? Let me rephrase that: are they those with factories installed in the EU territory or European companies, with headquarters there? It's crucial to set this straight, even if European politicians have already disclosed the definition they chose to follow without directly admitting that.

The European Commission (EC) conducted an investigation for nine months and came to the conclusion that automakers in China enjoyed unfair competitive advantages that ranged from inexpensive land for the factories to direct subsidies from the government. Add cheap loans and subsidized battery materials to the list. To make matters worse, we recently discovered that only two Chinese BEV makers are profitable, but I'll keep this discussion for another time.

The automakers that cooperated with the EC were penalized with lower extra duties. That was the case for BYD and the 17.4% it has to pay on top of the 10% import tax. SAIC is a state-owned company that was not very transparent with the EC investigations. That's why it has to pay 38.1% in extra taxes, the highest ones imposed on any Chinese automaker. European or American companies that did not hold information back have to pay a "weighted average duty" of 21%. The logic for a higher percentage than that a cooperative Chinese company such as BYD enjoys is not clear, but it may have to do with forcing these automakers to manufacture in Europe, not in China. Ironically, all of them already do.

The EC decision caused protests from Chinese officials, but it is controversial even in its own territory: it was taken despite appeals from European carmakers to avoid that, especially from Volkswagen. The German company feared that this could cause a payback. In other words, the Chinese government could decide to retaliate against foreign automakers in response to the extra duties. As one of the historic sales leaders in the world's largest car market, Volkswagen has a lot at stake, especially because the Chinese Communist Party (CCP) can retaliate in more ways than just with taxes.

In September 2012, Japan nationalized the Senkaku Islands in the East China Sea. In China, they are the Diaoyu Islands. The CCP also wanted them, even if Japan had already occupied the land. A while after Japan's move, violent anti-Japanese protests erupted in China. Toyota and Honda dealerships were burned down. Toyota sales dropped 48.9% that month, while Honda and Nissan respectively had a decrease of 40.5% and 35% of their sales in the same period. It is hard to believe this would happen spontaneously, especially in a dictatorship. Only authorized protests can happen in China.

What if this protection the EC is trying to create actually damages sales of European brands in China? Selling fewer cars in the country that buys more vehicles in the world may cause a massive dent in the financial health of several automakers. To make matters worse, they are already selling in lower numbers there.

BYD was the first local company to beat Volkswagen on the Chinese sales charts. In 2023, it started an intense internationalization strategy to export its vehicles to multiple countries, including those in the EU. At first, it seemed it wanted to sell the cars the Chinese market was unwilling to absorb, but BYD soon announced several factories abroad, such as the ones in Brazil, Thailand, Uzbekistan, and Hungary. This last plant alone, announced in December 2023, already ensures the company's presence in Europe. Production should begin in 2025, but there is no word on investments or production goals.

The Turkish plant came with more details, probably because BYD thought it was wise to release them after the EU said it would charge extra duties. Turkey applied to be an EU member decades ago and has had a free trade agreement in place since 1995. BYD's $1-billion factory will start to operate there in 2026, and it will employ up to 5,000 workers. The Chinese carmaker wants it to produce 150,000 cars per year, but it is not clear if that is the full capacity or if the plant can improve its output.

At this point, it may seem that European politicians are just trying to level the playing field for all players, regardless of where they come from. In other words, if Chinese companies want to invest in Europe, they are more than welcome to do so. Just check Italy's example.

Reuters reported on July 12 that the Italian government was planning to take over some brands from Stellantis by decree. The idea was to offer them to Chinese automakers willing to take them back to life, as long as it was with factories in Italy. The brands in question are Autobianchi and Innocenti. Abarth could be in the same package if Stellantis had not used it in the last five years.

In April, Adolfo Urso, Italy's industry minister, said Stellantis could not name its new small Alfa Romeo SUV Milano because it was against the law. According to the minister, that would mislead customers into thinking the car was made in Italy. Although that is debatable, Stellantis preferred not to discuss it and changed the car's name to Junior. Carlos Tavares told Automotive News that manufacturing it in Tychy, Poland, allows the company to cut €10,000 from its price. Urso would probably approve it if a Chinese carmaker made an Autobianchi Milano.

Whether this will happen or not, the idea itself is pretty revealing. For the Italian government, the local automotive industry is composed of those that have factories in the country, regardless of where they are from. As long as they employ people in Italy, they could be from anywhere, perhaps even from Russia or North Korea. Workers and their families are voters; what matters is whether these voters can pay their bills each month, regardless of who employs them. The least that can be said about this is that it is a shortsighted approach.

European manufacturers have been warning about the lack of competitiveness they have faced in their home markets for years. It is too expensive to make cars in Germany, Italy, and France, which has initially moved production to Spain and Portugal. Nowadays, it is concentrating on Romania, Turkey, Poland, Czechia, and, most of all, Hungary. That is similar to what happened with the US and Mexico, turning the latter into a manufacturing powerhouse. The name of the game is production costs. What have politicians done to reduce them in their countries?

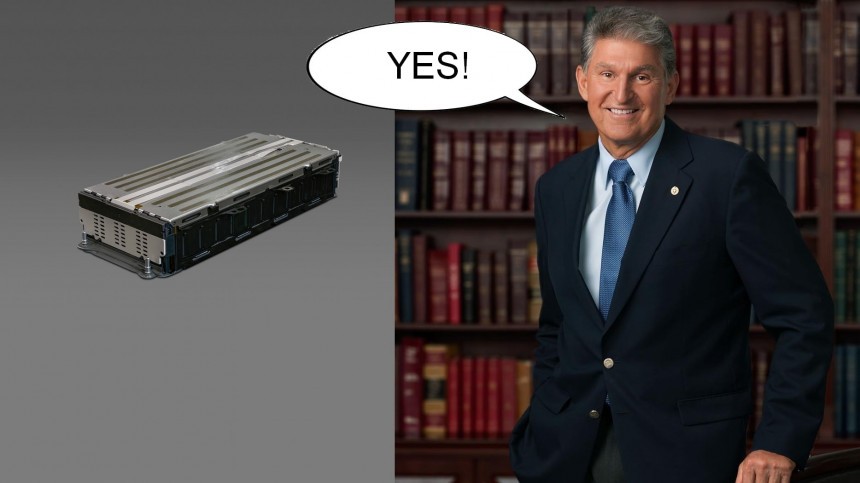

The truth is that money does not hold a passport. Carmakers will invest wherever they can have more profits. However, can you deal with automotive companies controlled or influenced by the Chinese government exactly like you do with any other? Or do they represent an "energy-safety" threat? Senator Joe Manchin said the Inflation Reduction Act (IRA) was created to avoid precisely that because China refines 90% of all raw materials for lithium-ion cells. That's why it pushes for BEVs made with components made in the US. What is the point of making these vehicles and importing the batteries from China? What if China decides it does not want to sell them anymore or will only do so at a much higher price?

Pushing for BEVs without balancing this production chain will place all car manufacturers in the hands of the CCP. Most of them already are there, mind you, either because it really controls them or because no one wants to fall from grace with the Chinese government.

Whether this discussion will make any difference in the future is something we cannot answer right now. For it to matter, it has to start, and I have no illusions whatsoever that this article will kickstart the process. Its main goal is to help people realize that European politicians do not care. As long as Chinese state-owned carmakers build factories in Europe, they will obviously consider them EU BEV producers.

The European Commission (EC) conducted an investigation for nine months and came to the conclusion that automakers in China enjoyed unfair competitive advantages that ranged from inexpensive land for the factories to direct subsidies from the government. Add cheap loans and subsidized battery materials to the list. To make matters worse, we recently discovered that only two Chinese BEV makers are profitable, but I'll keep this discussion for another time.

The EC decision caused protests from Chinese officials, but it is controversial even in its own territory: it was taken despite appeals from European carmakers to avoid that, especially from Volkswagen. The German company feared that this could cause a payback. In other words, the Chinese government could decide to retaliate against foreign automakers in response to the extra duties. As one of the historic sales leaders in the world's largest car market, Volkswagen has a lot at stake, especially because the Chinese Communist Party (CCP) can retaliate in more ways than just with taxes.

In September 2012, Japan nationalized the Senkaku Islands in the East China Sea. In China, they are the Diaoyu Islands. The CCP also wanted them, even if Japan had already occupied the land. A while after Japan's move, violent anti-Japanese protests erupted in China. Toyota and Honda dealerships were burned down. Toyota sales dropped 48.9% that month, while Honda and Nissan respectively had a decrease of 40.5% and 35% of their sales in the same period. It is hard to believe this would happen spontaneously, especially in a dictatorship. Only authorized protests can happen in China.

BYD was the first local company to beat Volkswagen on the Chinese sales charts. In 2023, it started an intense internationalization strategy to export its vehicles to multiple countries, including those in the EU. At first, it seemed it wanted to sell the cars the Chinese market was unwilling to absorb, but BYD soon announced several factories abroad, such as the ones in Brazil, Thailand, Uzbekistan, and Hungary. This last plant alone, announced in December 2023, already ensures the company's presence in Europe. Production should begin in 2025, but there is no word on investments or production goals.

The Turkish plant came with more details, probably because BYD thought it was wise to release them after the EU said it would charge extra duties. Turkey applied to be an EU member decades ago and has had a free trade agreement in place since 1995. BYD's $1-billion factory will start to operate there in 2026, and it will employ up to 5,000 workers. The Chinese carmaker wants it to produce 150,000 cars per year, but it is not clear if that is the full capacity or if the plant can improve its output.

Reuters reported on July 12 that the Italian government was planning to take over some brands from Stellantis by decree. The idea was to offer them to Chinese automakers willing to take them back to life, as long as it was with factories in Italy. The brands in question are Autobianchi and Innocenti. Abarth could be in the same package if Stellantis had not used it in the last five years.

In April, Adolfo Urso, Italy's industry minister, said Stellantis could not name its new small Alfa Romeo SUV Milano because it was against the law. According to the minister, that would mislead customers into thinking the car was made in Italy. Although that is debatable, Stellantis preferred not to discuss it and changed the car's name to Junior. Carlos Tavares told Automotive News that manufacturing it in Tychy, Poland, allows the company to cut €10,000 from its price. Urso would probably approve it if a Chinese carmaker made an Autobianchi Milano.

European manufacturers have been warning about the lack of competitiveness they have faced in their home markets for years. It is too expensive to make cars in Germany, Italy, and France, which has initially moved production to Spain and Portugal. Nowadays, it is concentrating on Romania, Turkey, Poland, Czechia, and, most of all, Hungary. That is similar to what happened with the US and Mexico, turning the latter into a manufacturing powerhouse. The name of the game is production costs. What have politicians done to reduce them in their countries?

The truth is that money does not hold a passport. Carmakers will invest wherever they can have more profits. However, can you deal with automotive companies controlled or influenced by the Chinese government exactly like you do with any other? Or do they represent an "energy-safety" threat? Senator Joe Manchin said the Inflation Reduction Act (IRA) was created to avoid precisely that because China refines 90% of all raw materials for lithium-ion cells. That's why it pushes for BEVs made with components made in the US. What is the point of making these vehicles and importing the batteries from China? What if China decides it does not want to sell them anymore or will only do so at a much higher price?

Whether this discussion will make any difference in the future is something we cannot answer right now. For it to matter, it has to start, and I have no illusions whatsoever that this article will kickstart the process. Its main goal is to help people realize that European politicians do not care. As long as Chinese state-owned carmakers build factories in Europe, they will obviously consider them EU BEV producers.